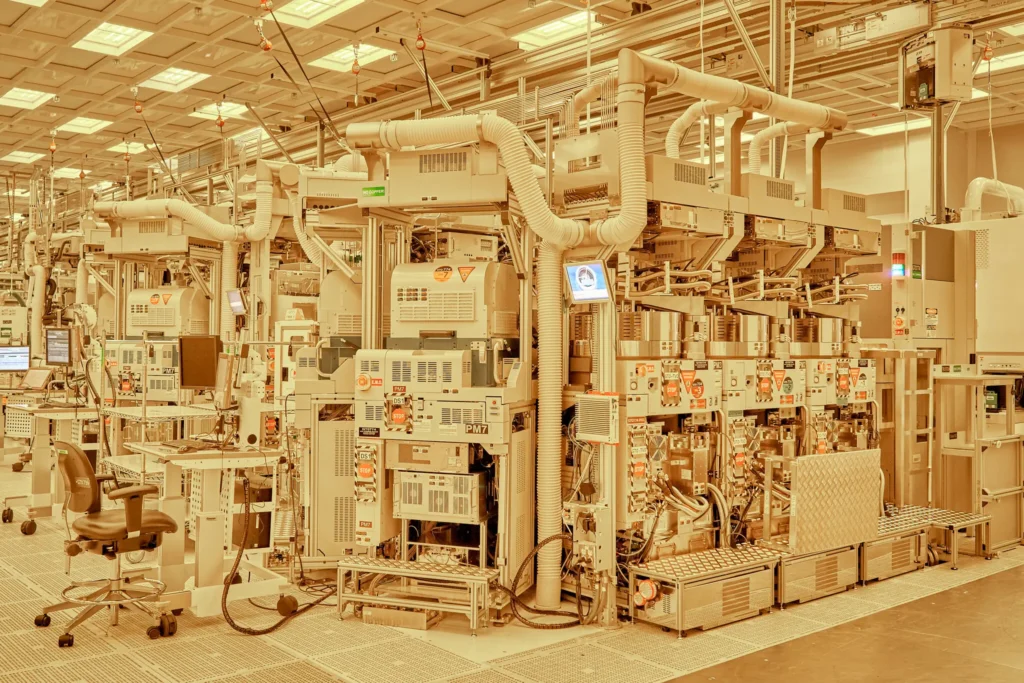

In a move reminiscent of past government rescues of major industries, Intel has agreed to sell a 10 percent ownership stake to the U.S. government for $8.9 billion. The deal marks one of the most significant federal interventions in a private company since the auto industry bailout following the 2008 financial crisis.

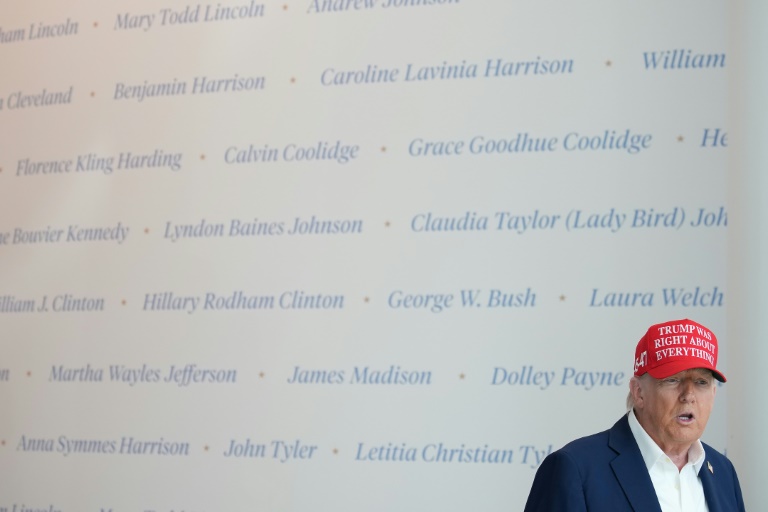

President Trump announced the agreement on Friday, saying it followed negotiations with Intel’s recently appointed chief executive, Lip-Bu Tan. “I told him it would be good for the United States to be a partner,” Mr. Trump said. “He agreed, and they’ve agreed to do it. I think it’s a great deal for them.”

Under the terms, Washington will invest nearly $9 billion in Intel shares in addition to $2.2 billion previously disbursed to the company through the CHIPS and Science Act, the 2022 program designed to boost domestic semiconductor production. The government will not hold a board seat or exercise governance rights.

Mr. Tan welcomed the move, saying Intel was “grateful for the confidence placed in us” and pledged to advance U.S. leadership in chipmaking. Commerce Secretary Howard Lutnick described the agreement as “historic,” saying it strengthens America’s position in a critical industry that powers everything from electronics to military hardware.

The deal underscores the Trump administration’s push to reshape the CHIPS Act. Officials have criticized the original program for offering grants without securing meaningful returns. Mr. Lutnick told CNBC the president had turned “money Biden was just going to give away” into “equity for the American people.”

Markets reacted positively, with Intel shares surging more than 6 percent. Once a pioneer that helped establish Silicon Valley’s dominance, Intel has stumbled in recent years, losing ground in mobile and artificial intelligence chips to rivals like Nvidia.

Talks between the administration and Intel accelerated over the past week. After initially calling for Mr. Tan’s resignation over his ties to Chinese firms, Mr. Trump later met with the executive at the White House, where the idea of a government equity stake was raised. By Wednesday, officials including Mr. Lutnick and Intel’s finance chief David Zinsner had settled on a framework, with the company’s board signing off shortly thereafter.

Legal questions could still loom. Experts have suggested that the CHIPS Act may not permit the conversion of federal grants into equity. Shareholders could also push back against the unprecedented arrangement.

The move reflects the Trump administration’s increasingly aggressive stance toward the semiconductor sector. The president has threatened to revoke subsidies, imposed limits on chip exports to China, floated steep tariffs, and demanded new U.S. factory investments. While the CHIPS Act allocated $50 billion to rebuild domestic chipmaking capacity, Trump has said he wants to “get rid of it” in its current form.

Intel itself has received more than $10 billion under the program for projects in Arizona, New Mexico, Ohio, and Oregon, as well as for Defense Department production. Still, the company has struggled, undergoing leadership changes and strategic pivots, including Mr. Tan’s plan to streamline staff and develop an AI-focused strategy.

Some analysts warn that government ownership will not automatically solve Intel’s competitive challenges. “Once the government becomes a stakeholder, the question is: what steps will they take to protect that investment?” said Ben Bajarin of Creative Strategies. “You can’t force customers to buy Intel chips. You need to create the conditions where they want to.”