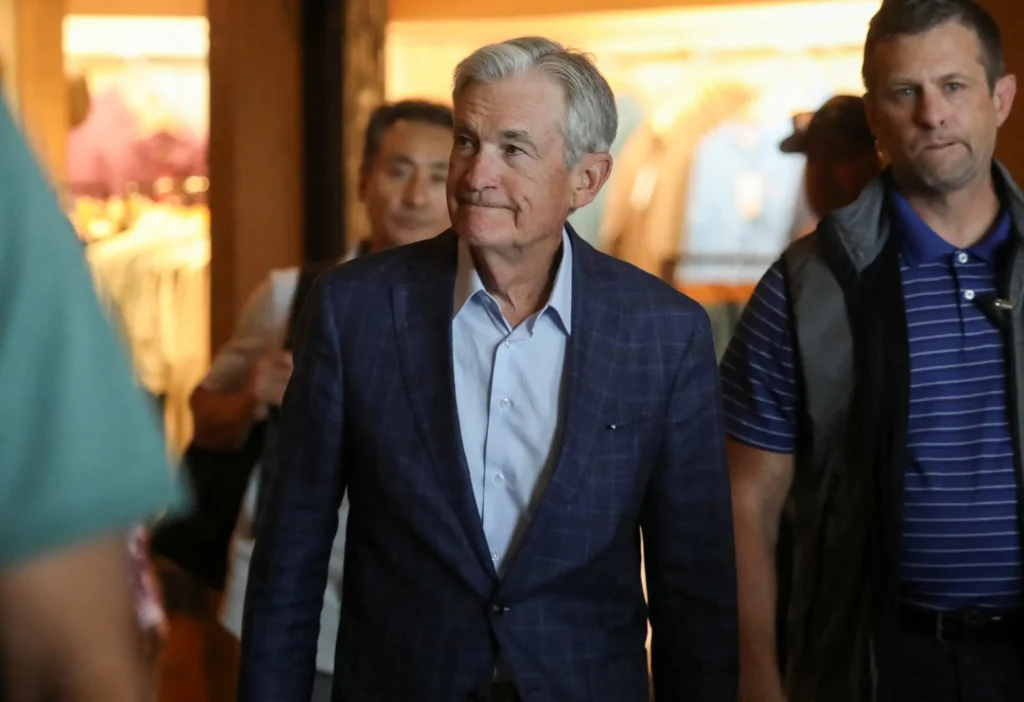

Federal Reserve Chair Jerome H. Powell signaled Friday that the central bank is preparing to ease borrowing costs in the near future, underscoring mounting concerns about the job market even as inflation remains stubbornly elevated.

Speaking at the Kansas City Fed’s annual gathering in Jackson Hole, Wyo., Mr. Powell stopped short of committing to a rate cut at the Fed’s September meeting. Still, his remarks made clear that policymakers see a shift in the economic outlook that could justify action.

“The balance of risks appears to be changing,” he said in his final address as Fed chair. With growth cooling, hiring slowing, and inflation showing signs of being contained, Powell noted that “the shifting balance of risks may warrant adjusting our policy stance.”

The Fed chief pointed to weakening employment trends and raised questions about whether slower job creation stems from softer demand or reduced labor supply due to President Trump’s immigration policies. The labor market, he said, is in a “curious balance” that could unravel quickly if layoffs accelerate.

At the same time, Powell acknowledged inflation is still higher than desired. He downplayed fears that tariffs would fuel long-lasting price pressures, describing the impact as more of a “one-time” adjustment spread over time.

Navigating between these two competing risks — inflation and employment — leaves the Fed in what Powell called a “challenging situation.” He emphasized the need to “proceed carefully,” suggesting that any rate cuts will be measured and gradual.

Markets welcomed the remarks. The S&P 500 climbed 1.5 percent, the Nasdaq added nearly 2 percent, and small-cap stocks surged more than 3 percent. Bond yields also dropped, with the two-year Treasury yield falling to 3.69 percent, as traders raised their bets on a September cut.

The backdrop, however, remains politically charged. President Trump has repeatedly attacked the Fed for keeping borrowing costs too high. On Friday, as Powell spoke, Trump escalated tensions by calling for the resignation of Fed Governor Lisa Cook, citing unverified allegations about her past finances. Cook denied the claims, vowing not to be “bullied” into leaving.

The president has long pressed for rates at least three percentage points lower than today’s 4.25 to 4.5 percent range. While the Fed held steady through the first half of 2025, internal divisions have sharpened. Two Trump-appointed officials, Christopher J. Waller and Michelle W. Bowman, dissented last month in favor of an immediate quarter-point cut.

Adding to the significance of Powell’s speech, he also unveiled a major revamp of the Fed’s policy framework, discarding the “flexible average inflation targeting” system adopted in 2020. That approach, which allowed inflation to temporarily run above 2 percent to offset prior shortfalls, quickly became outdated when inflation spiked to four-decade highs in 2022.

Powell declared the “makeup strategy” obsolete and said the Fed would return to a more straightforward approach, no longer focusing on “shortfalls” in employment but instead on overall deviations from maximum employment. The changes, he said, are designed to give the Fed greater flexibility across a wider range of economic conditions.